boulder co sales tax license

This includes sales made to students faculty and staff not acting in an agent capacity on behalf of the university companies the general public and conference catering. The Boulder County sales tax rate is.

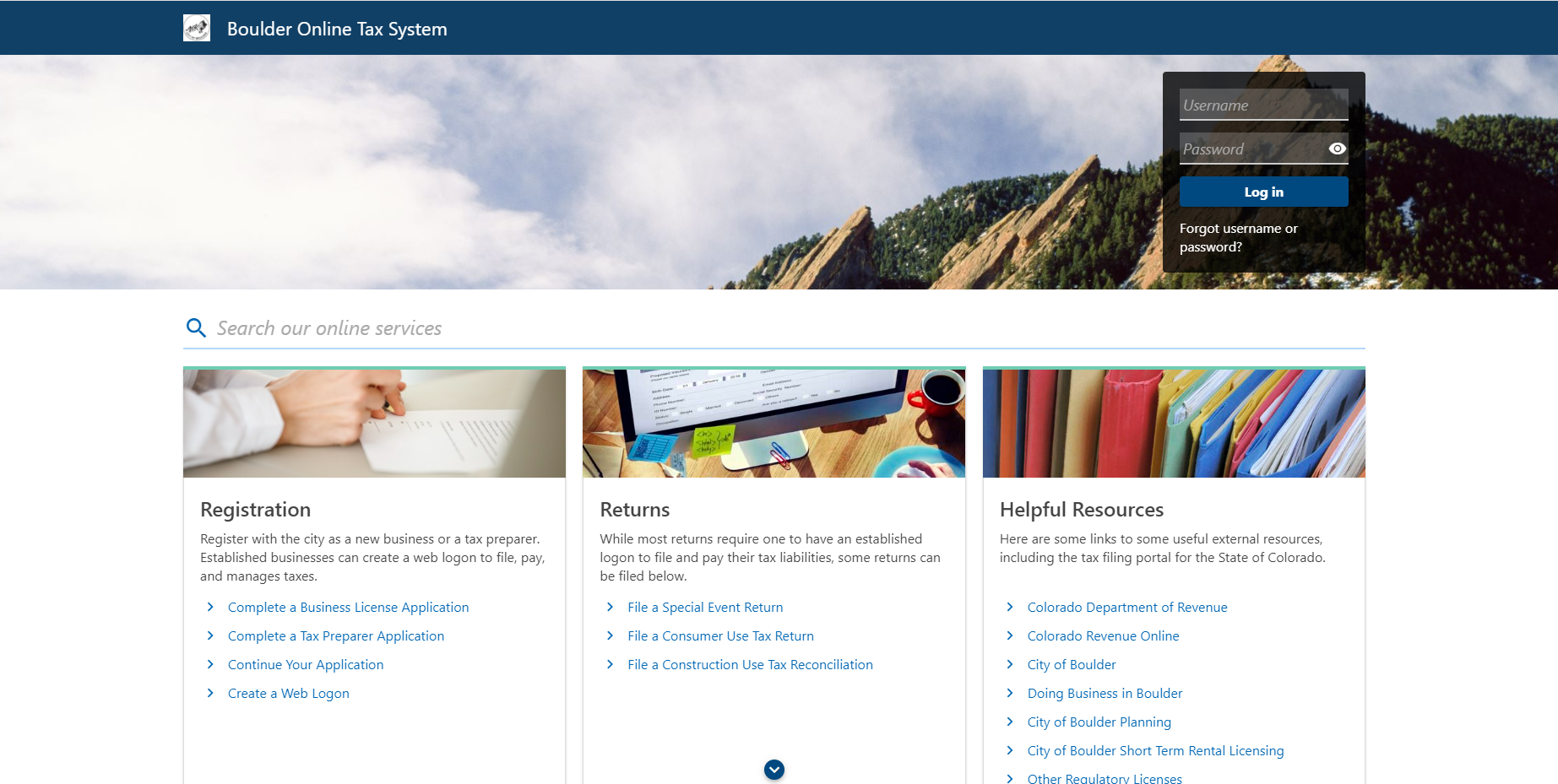

The Boulder Online Tax System offers enhanced user experiences and tax compliance functionality to city businesses including the ability to.

. Ad New State Sales Tax Registration. Proof of paid sales tax is required at the time of registration see instructions for sales tax paid to another state. Those engaged in business in the City of Boulder.

The Colorado sales tax license in other parts of the country may be called a resellers license a vendors license or a resale certificate is for state and state-administered sales and use taxes. Ad Apply For Your Colorado Sales Tax License. State county city and regional transportation district sales use taxes are based on the.

A sales tax license is required in order to collect and remit sales tax that is collected by the Colorado Department of Revenue. If another city tax is charged and the vendor is not licensed with Boulder it is not a legally imposed tax and credit is not allowed. If a vehicle is purchased from a private party all sales taxes are collected by Boulder County Motor Vehicle.

Purchaser should contact vendor for refund of the taxes charged in error. Excess Tax Collected 000 7. Any unpaid sales taxes are collected by Boulder County Motor Vehicle.

Boulder County 0985 TOTAL Combined Sales Tax Rate in Longmont. The minimum combined 2022 sales tax rate for Boulder County Colorado is. Boulder County 0985 TOTAL Combined Sales Tax Rate in Longmont.

The Colorado state sales tax rate is currently. For organizations not based permanently in the City of Boulder we have a Special Event License available. Return the completed form in person 8-5 M-F or by mail.

Has impacted many state nexus laws and sales tax collection requirements. This page serves as a guide to navigating the Special Event tax system and the City. State Tax Id Number also called an Employer Identification Number or EIN or Boulder Sales Tax ID number also called a reseller number resale number sellers number wholesale retail or resale certificate.

In all likelihood the Renewal Application For Sales Tax License is not the only document you should review as you seek business license compliance in Boulder CO. The Boulder Revised Code defines engaged in business in the city as. Boulder-county Licenses and Permits.

Boulder-county sales-tax-registration File for boulder-county Business Licenses and boulder-county Permits at an affordable priceDont waste your time run your small business - avoid the paperwork the hassle and the delays by filing for licenses and permits online. Amount of city FOOD SERVICE TAX 015 of line 5B 6. Renewed licenses will be valid for a two-year period that began on January 1 2020.

There are some CU Boulder campus departments that have a large volume of sales. For questions about city taxes and licensing please call the City Boulder Sales Tax Division at 303 441-3051 email at salestaxbouldercoloradogov or send a message through Boulder Online Tax. The City of Boulder requires all organizations and businesses coming into Boulder for Special Events to obtain a City of Boulder business license and file a sales use tax return.

To set up any or the above or a federal tax ID number also called an Employer Identification Number or EIN contact our. Skip the Lines Apply Online Today. Sometimes taxpayers refer to this as a business registration but it is an application for a Colorado sales tax account or sales tax license.

How to Apply for a Sales and Use Tax License. File online tax returns with electronic payment options. Longmont Sales Tax Division 350 Kimbark St Longmont CO 80501.

A Boulder Colorado Sales Tax Permit can only be obtained through an authorized government agency. Get started with a sales tax boulder form 0 complete it in a few clicks and submit it securely. Please visit our web site at.

City of Boulder Sales Tax Form. When the university sells tangible property to non-university non-tax-exempt entities the sale is subject to sales tax. Vendor must have a Boulder sales tax license in order to charge and collect Boulder tax.

13 rows Boulder County does not issue licenses for sales tax as the county sales tax is. Visit Where can I get vaccinated or call 1-877-COVAXCO 1-877-268-2926 for vaccine information. Httpsbouldercoloradogovtax-licensesales-and-use-tax for more information on tax and licensing including tax rates tax guidance and FAQs.

Complete a Business License application or register for a Special Event License. Therefore all businesses engaged in business in the city must have a City of Boulder business license. A Boulder Colorado Sales Tax Permit can only be obtained through an authorized government agency.

Sent direct messages to Sales Tax Staff. Sales 000 of line 4 000 000 5C. We recommend that you obtain a Business License Compliance Package BLCP.

If Boulder tax is properly charged credit is allowed. How to Apply for a Sales and Use Tax License. Sale Tax License information registration support.

Sales Tax Accounts Licenses. Complete in Just 3 Steps. Fast Easy and Secure Online Filing.

Colorados state sales tax is 9 and its 0 percent. Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get a Boulder Colorado Sales Tax Permit. This is the total of state county and city sales tax rates.

Ad Fill out a simple online application now and receive yours in under 5 days. Each physical location must have its own license and pay a 16 renewal fee. The 2018 United States Supreme Court decision in South Dakota v.

This is the total of state and county sales tax rates. The City of Boulder is considered a home-rule city meaning it administers Boulder sales tax separately from the State of Colorado.

Getting Your Business Established In Boulder Colorado

Moving To Boulder Boulder Co Relocation Homebuyer Guide

Sales And Use Tax City Of Boulder

Sales Tax Campus Controller S Office University Of Colorado Boulder

Boulder Colorado Co Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Sales Tax Campus Controller S Office University Of Colorado Boulder

Domestic Abuse Information And Resources Boulder County

315 Bellevue Dr Boulder Co 80302 Realtor Com

Getting Your Business Established In Boulder Colorado

Construction Use Tax City Of Boulder

City Of Boulder Colorado Sales Use Tax Return Form Download Fillable Pdf Templateroller

Boulder Skyline Art Print Boulder Decor Colorado Flatirons Etsy

Sales Tax Campus Controller S Office University Of Colorado Boulder

Boulder Colorado Co Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Short Term Dwelling And Vacation Rental Licensing Boulder County